Every year at this time the United States Postal Service releases its new postage rates for the coming year.

While at first glance these changes may appear to be minor, they can actually have a significant impact on your 2021 budget.

We highly recommend that you begin analyzing the impact of these changes on your policyholder communications now. Small increases, when extrapolated through the full year and applied to the total number of mailings you send, can end up causing a big variance on your spend year-over-year.

Being aware of these changes and applying a thorough analysis will help you more accurately estimate your budget, preventing potential issues later in the year. A timely analysis can also help you find ways to offset exposure or discover new savings opportunities.

To help you start your 2021 analysis, below are some highlights we find to be most pertinent to you:

While Metered Single-Piece letters did not experience an increase at this time last year, they are increasing 2% by $0.01 in 2020. The AADC rate for #10s and 6 x 9’s is increasing by .009, while the Mixed AADC rate is increasing $0.011 and the 5-Digit rate is increasing $0.009.

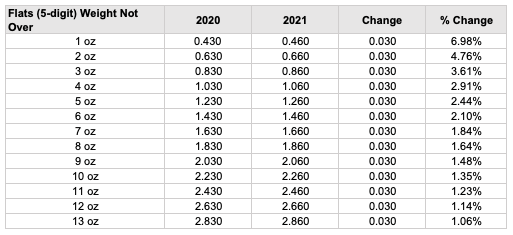

New Business Policies and large Renewals will be impacted by the changes below. In a reversal from the increases we saw last year, in 2021, the lighter the weight, the higher the increase. Last year was the opposite. In addition to the flats postage rates changing, there will most likely be an increase in the Presort Fees for flats which is to be determined at this time.

Parcel Select Ground charges weighing between 1 and 6 pounds will all go up, with the biggest increase being packages 1 pound or less.

The Certificate of Mailing fee will increase by $0.01, from $0.43 in 2020 to $0.44 in 2021.

Certified Mail costs will also go up in 2021, going from $3.55 in 2020 to $3.60 in 2021. While retail Return Receipt fees will remain steady, electronic Return Receipts will raise by $0.05.

If you’re a MassPrinting client and have questions about the changes to the 2021 postal rates and how they impact your policyholder communications, feel free to contact us! We’re happy to walk through the changes with you.